Figure out taxes on paycheck

The state tax year is also 12 months but it differs from state to state. Web Multiply the current Social Security tax rate by the amount of gross wages subject to Social Security.

Paycheck Taxes Federal State Local Withholding H R Block

However they dont include all taxes related to payroll.

. Free Unbiased Reviews Top Picks. It can also be used to help fill steps 3 and 4 of a W-4 form. Taxpayers can help determine the right.

Because federal income tax is a pay-as-you-go tax. 69400 wages 44475 24925 in wages taxed at 22. In this process you.

In Sallys example above her FICA withholding for each. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Each employer withholds 62 of your gross income for Social.

Web If you make 55000 a year living in the region of New York USA you will be taxed 11959. That means that your net pay will be 43041 per year or 3587 per month. Get an accurate picture of the employees.

Web Withholding tax is a portion of federal income tax that an employer withholds from an employees paycheck. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. Web If you earn at least a specified amount for at least 40 quarters you can get Social Security benefits when you retire.

Browse Get Results Instantly. Learn About Payroll Tax Systems. Sign Up Today And Join The Team.

Web Annual gross salary number of pay periods gross pay for salaried employees. This means that your net pay will be 43113. Estimate your federal income tax withholding.

Use this tool to. Of course these figures and the tax rates. Web Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Web Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security.

For example if a salaried employees gross pay is 40000 and you want to. Simplify Upgrade Enjoy Easy Payroll Tailored To Your Needs. Ad Compare This Years Top 5 Free Payroll Software.

Ad Search For Info About Payroll tax calculator. Learn About Payroll Tax Systems. Web Free salary hourly and more paycheck calculators.

Web FICA taxes are commonly called the payroll tax. All Services Backed by Tax Guarantee. Web How It Works.

Web In addition you need to calculate 22 of the earnings that are over 44475. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

69400 wages 44475 24925 in wages taxed at 22. Web The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. FICA taxes consist of Social Security and Medicare taxes.

Web Social Security tax. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Web IR-2019-178 Get Ready for Taxes.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Sign Up Today And Join The Team. The maximum an employee will pay in 2022 is.

Web Because of the numerous taxes withheld and the differing rates it can be tough to figure out how much youll take home. This is 548350 in FIT. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

See how your refund take-home pay or tax due are affected by withholding amount. For example if an employee earns 1500 per week the. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Web In total you are going to pay 11888 tax every year for making 55000 in a year in Maine. Some states follow the. Instead of the 300 credit.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. This is 548350 in FIT. Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Over 900000 Businesses Utilize Our Fast Easy Payroll. Calculate the net tax that you need to pay keeping the income tax slabs for FY 2022-23 in mind. Web In addition you need to calculate 22 of the earnings that are over 44475.

Web To determine your hourly gross rate of pay divide your annual salary by 52176 to obtain the weekly rate and then by the number of hours in your standard work. Thats where our paycheck calculator comes in. Web Mississippi property tax laws have special rules for senior citizens who are older than 65 and people who are disabled regardless of age.

Web Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings. Web Determination of the amount of tax payable.

Ad Choose From the Best Paycheck Companies Tailored To Your Needs. Get ready today to file 2019 federal income tax returns. Determine if state income tax and other state and local.

Florida Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

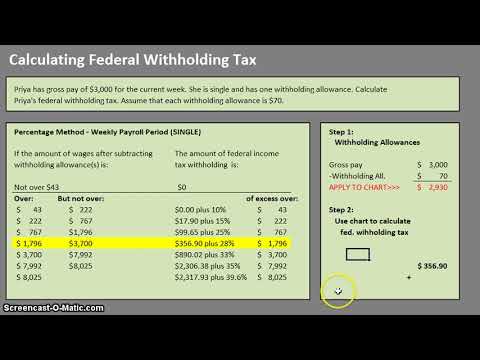

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

What Are Employer Taxes And Employee Taxes Gusto

How To Calculate Net Pay Step By Step Example

Understanding Your Paycheck Credit Com

How To Calculate Federal Withholding Tax Youtube

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Tax What It Is How To Calculate It Bench Accounting

Understanding Your Paycheck

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

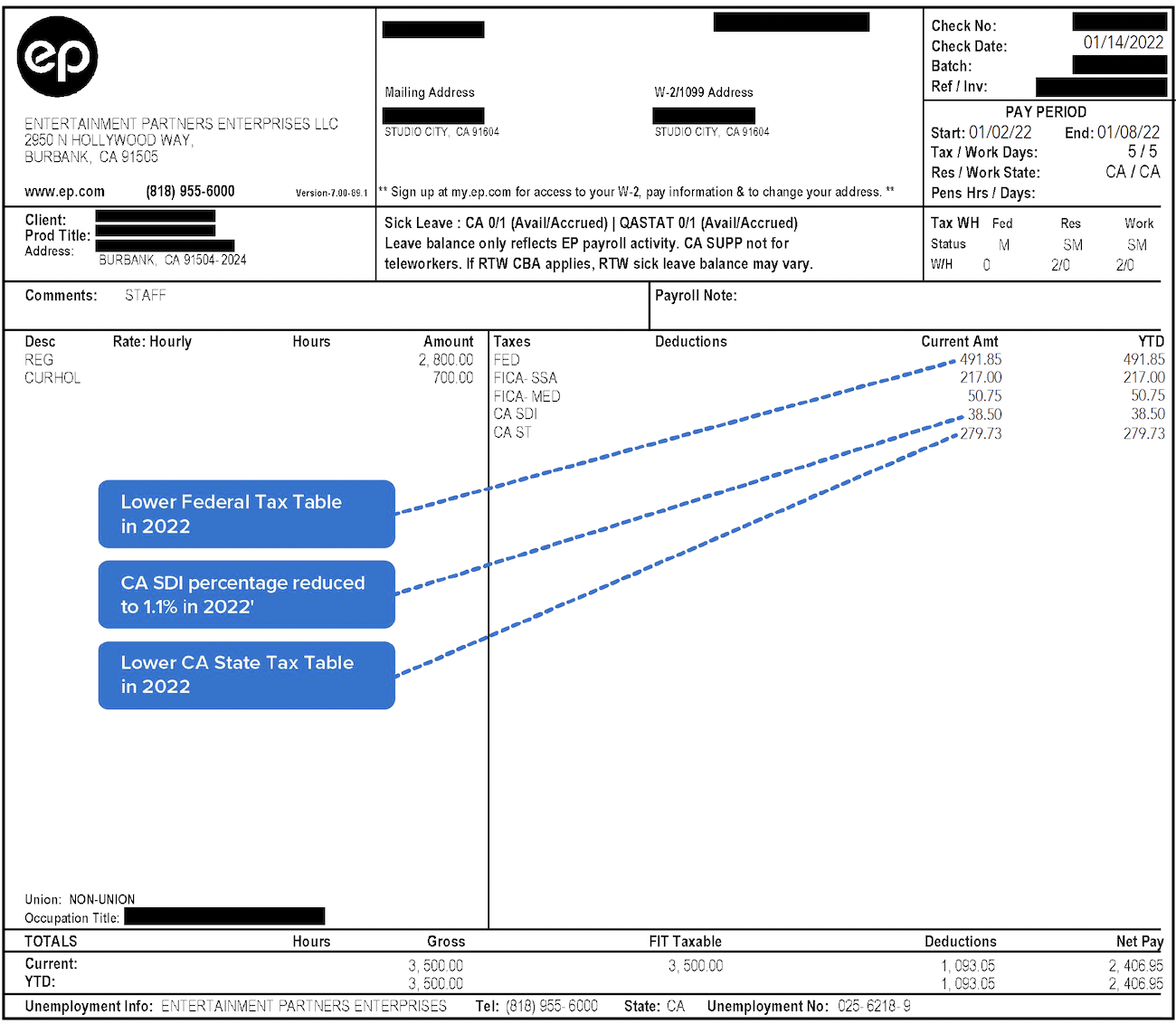

Decoding Your Paystub In 2022 Entertainment Partners