35+ tax deduction on mortgage interest

If you are married and filing separately then its limited to. Some interest can be claimed as a deduction or as a credit.

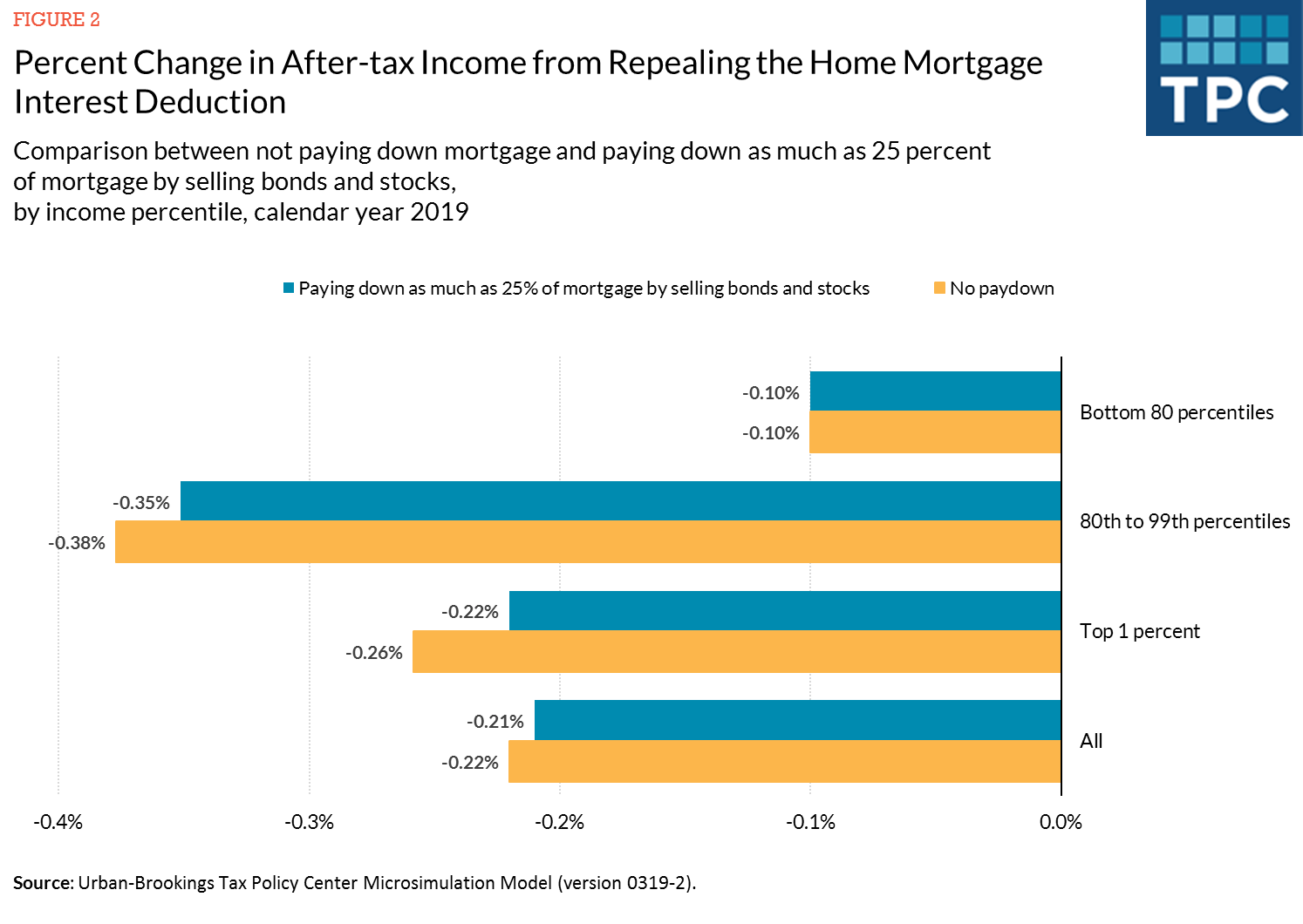

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

For taxpayers who use.

. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web If your home was purchased before Dec. Interest is an amount you pay for the use of borrowed money.

Dont Leave Money On The Table with HR Block. Interest on mortgage and home equity debt. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Web Here are four of them. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

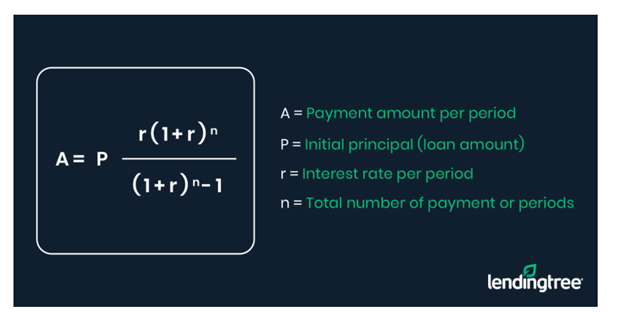

TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent. Learn More at AARP.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. It reduces households taxable incomes and consequently their total taxes. For example if you paid 300000 for your home each point.

Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest on. Web Topic No. Taxes Can Be Complex.

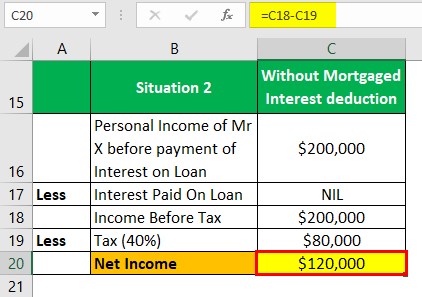

Web A taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4200 tax deduction. Divide line 11 by line 12. Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Web Here is an example of what will be the scenario to some people. Homeowners who are married but filing. I refinanced the mortgage and have 3 1098s 1 from the original.

Homeowners who bought houses before. Web You can only deduct mortgage interest on the first 750000 of your mortgage if you file single or married filing jointly. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. You can take a. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

However higher limitations 1 million 500000 if married. Taxes Can Be Complex. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Get Your Max Refund Guaranteed. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Multiply line 13 by the decimal.

Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. If you borrow for a home you can take a mortgage interest deduction. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Our Tax Pros Have an Average Of 10 Years Experience. It all depends on how the property is used. Web The short answer is.

Web My TurboTax Premier software is not deducting mortgage interest on an under 750k mortgage. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

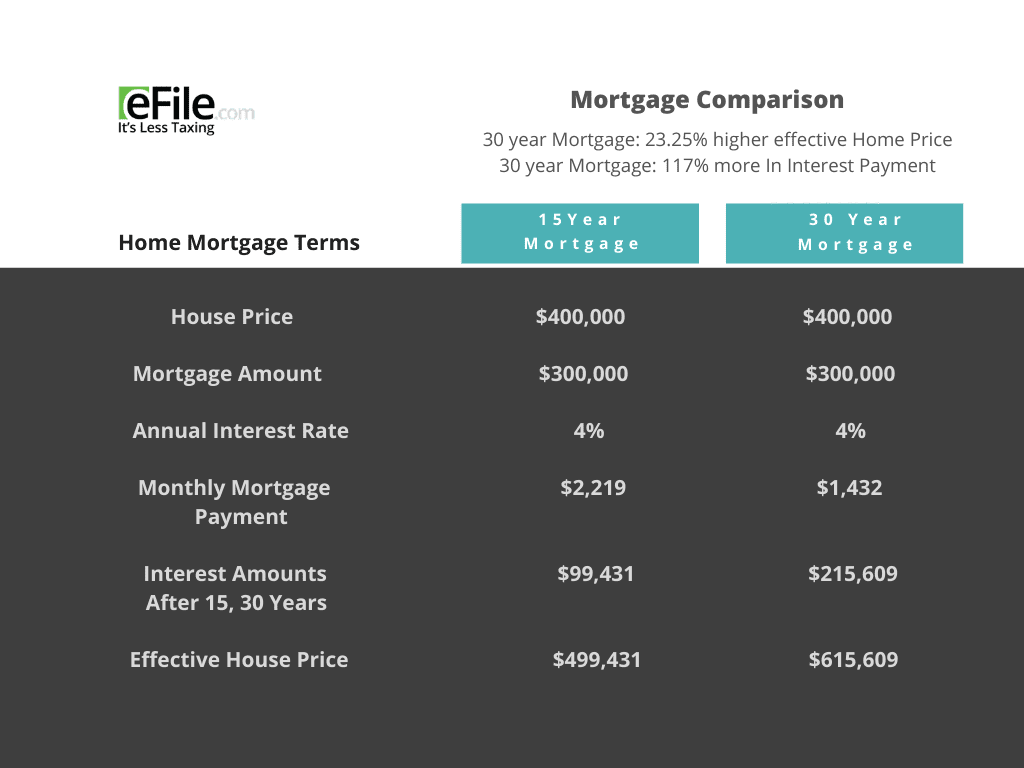

Web Each point that you buy generally costs 1 of the total loan and lowers your interest rate by 025. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must. Web February 13 2023 in Understanding the Mortgage Interest Deduction.

Web Total amount of interest that you paid on the loans from line 12 not reported on form 1098.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

It S Time To Gut The Mortgage Interest Deduction

Calculating The Home Mortgage Interest Deduction Hmid

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada

Home Mortgage Loan Interest Payments Points Deduction

What Is The Schedule 1 Tax Form Quora

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction How It Calculate Tax Savings

Ktba Rmx Dcvsm

The Home Mortgage Interest Deduction Lendingtree

Where Oh Where To Deduct Mortgage Interest U Of I Tax School

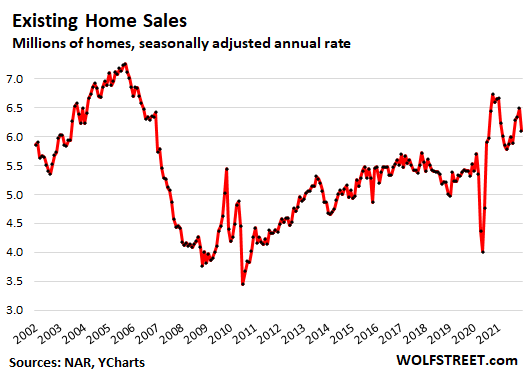

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

What Percentage Of My Mortgage Interest Will I Get Back From My Tax Return Quora

Maximum Mortgage Tax Deduction Benefit Depends On Income

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

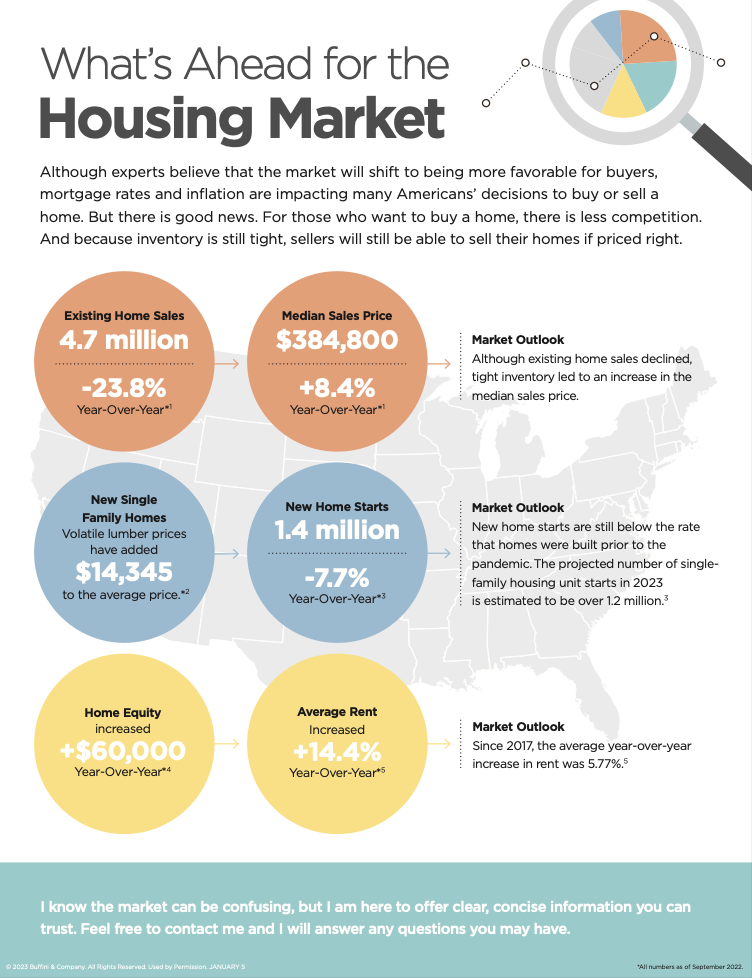

Blog Posts Carl Johnson Real Estate